Page 14 - Q1-2023-EN

P. 14

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2023

(All amounts are in Kuwaiti Dinars)

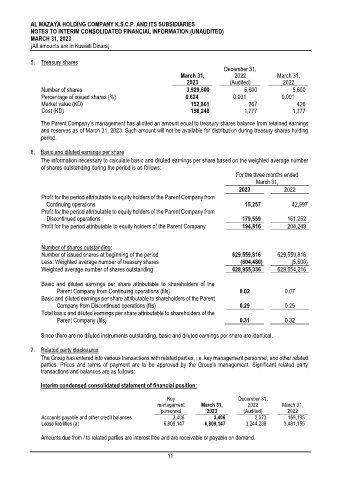

5. Treasury shares

December 31,

March 31, 2022 March 31,

2023 (Audited) 2022

Number of shares 3,929,600 5,600 5,600

Percentage of issued shares (%) 0.624 0.001 0.001

Market value (KD) 152,861 267 426

Cost (KD) 158,248 1,777 1,777

The Parent Company’s management has allotted an amount equal to treasury shares balance from retained earnings

and reserves as of March 31, 2023. Such amount will not be available for distribution during treasury shares holding

period.

6. Basic and diluted earnings per share

The information necessary to calculate basic and diluted earnings per share based on the weighted average number

of shares outstanding during the period is as follows:

For the three months ended

March 31,

2023 2022

Profit for the period attributable to equity holders of the Parent Company from

Continuing operations 15,257 42,997

Profit for the period attributable to equity holders of the Parent Company from

Discontinued operations 179,559 161,252

Profit for the period attributable to equity holders of the Parent Company 194,816 204,249

Number of shares outstanding:

Number of issued shares at beginning of the period 629,559,816 629,559,816

Less: Weighted average number of treasury shares (604,480) (5,600)

Weighted average number of shares outstanding 628,955,336 629,554,216

Basic and diluted earnings per share attributable to shareholders of the

Parent Company from Continuing operations (fils) 0.02 0.07

Basic and diluted earnings per share attributable to shareholders of the Parent

Company from Discontinued operations (fils) 0.29 0.25

Total basic and diluted earnings per share attributable to shareholders of the

Parent Company (fils) 0.31 0.32

Since there are no diluted instruments outstanding, basic and diluted earnings per share are identical.

7. Related party disclosures

The Group has entered into various transactions with related parties, i.e. key management personnel, and other related

parties. Prices and terms of payment are to be approved by the Group's management. Significant related party

transactions and balances are as follows:

Interim condensed consolidated statement of financial position:

Key December 31,

management March 31, 2022 March 31,

personnel 2023 (Audited) 2022

Accounts payable and other credit balances 3,406 3,406 2,073 169,195

Lease liabilities (a) 6,809,147 6,809,147 3,244,238 3,481,155

Amounts due from / to related parties are interest free and are receivable or payable on demand.

11