Page 13 - Q1-2023-EN

P. 13

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2023

(All amounts are in Kuwaiti Dinars)

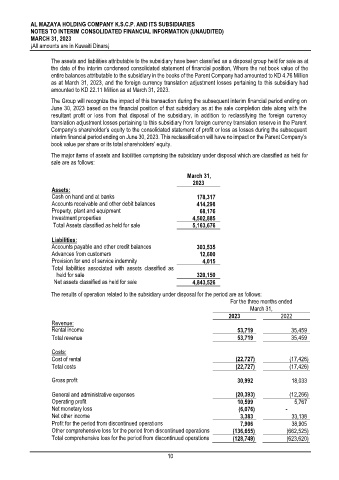

The assets and liabilities attributable to the subsidiary have been classified as a disposal group held for sale as at

the date of the interim condensed consolidated statement of financial position, Where the net book value of the

entire balances attributable to the subsidiary in the books of the Parent Company had amounted to KD 4.76 Million

as at March 31, 2023, and the foreign currency translation adjustment losses pertaining to this subsidiary had

amounted to KD 22.11 Million as at March 31, 2023.

The Group will recognize the impact of this transaction during the subsequent interim financial period ending on

June 30, 2023 based on the financial position of that subsidiary as at the sale completion date along with the

resultant profit or loss from that disposal of the subsidiary, in addition to reclassifying the foreign currency

translation adjustment losses pertaining to this subsidiary from foreign currency translation reserve in the Parent

Company’s shareholder’s equity to the consolidated statement of profit or loss as losses during the subsequent

interim financial period ending on June 30, 2023. This reclassification will have no impact on the Parent Company’s

book value per share or its total shareholders’ equity.

The major items of assets and liabilities comprising the subsidiary under disposal which are classified as held for

sale are as follows:

March 31,

2023

Assets:

Cash on hand and at banks 178,317

Accounts receivable and other debit balances 414,298

Property, plant and equipment 68,176

Investment properties 4,502,885

Total Assets classified as held for sale 5,163,676

Liabilities:

Accounts payable and other credit balances 303,535

Advances from customers 12,600

Provision for end of service indemnity 4,015

Total liabilities associated with assets classified as

held for sale 320,150

Net assets classified as held for sale 4,843,526

The results of operation related to the subsidiary under disposal for the period are as follows:

For the three months ended

March 31,

2023 2022

Revenue:

Rental income 53,719 35,459

Total revenue 53,719 35,459

Costs:

Cost of rental (22,727) (17,426)

Total costs (22,727) (17,426)

Gross profit 30,992 18,033

General and administrative expenses (20,393) (12,266)

Operating profit 10,599 5,767

Net monetary loss (6,076) -

Net other income 3,383 33,138

Profit for the period from discontinued operations 7,906 38,905

Other comprehensive loss for the period from discontinued operations (136,655) (662,525)

Total comprehensive loss for the period from discontinued operations (128,749) (623,620)

10