Page 19 - Q1-2023-EN

P. 19

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2023

(All amounts are in Kuwaiti Dinars)

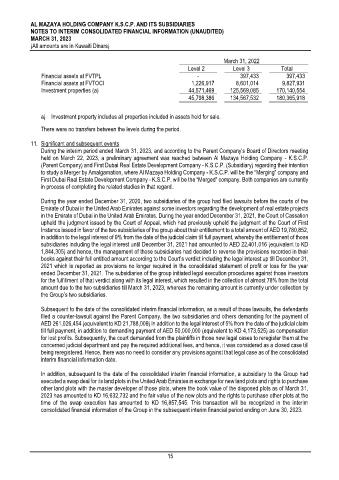

March 31, 2022

Level 2 Level 3 Total

Financial assets at FVTPL - 397,433 397,433

Financial assets at FVTOCI 1,226,917 8,601,014 9,827,931

Investment properties (a) 44,571,469 125,569,085 170,140,554

45,798,386 134,567,532 180,365,918

a) Investment property includes all properties included in assets held for sale.

There were no transfers between the levels during the period.

11. Significant and subsequent events

During the interim period ended March 31, 2023, and according to the Parent Company’s Board of Directors meeting

held on March 22, 2023, a preliminary agreement was reached between Al Mazaya Holding Company - K.S.C.P.

(Parent Company) and First Dubai Real Estate Development Company - K.S.C.P. (Subsidiary) regarding their intention

to study a Merger by Amalgamation, where Al Mazaya Holding Company - K.S.C.P. will be the “Merging” company and

First Dubai Real Estate Development Company - K.S.C.P. will be the “Merged” company. Both companies are currently

in process of completing the related studies in that regard..

During the year ended December 31, 2020, two subsidiaries of the group had filed lawsuits before the courts of the

Emirate of Dubai in the United Arab Emirates against some investors regarding the development of real estate projects

in the Emirate of Dubai in the United Arab Emirates. During the year ended December 31, 2021, the Court of Cassation

upheld the judgment issued by the Court of Appeal, which had previously upheld the judgment of the Court of First

Instance issued in favor of the two subsidiaries of the group about their entitlement to a total amount of AED 19,780,852,

in addition to the legal interest of 9% from the date of the judicial claim till full payment, whereby the entitlement of those

subsidiaries including the legal interest until December 31, 2021 had amounted to AED 22,401,016 (equivalent to KD

1,844,305) and hence, the management of those subsidiaries had decided to reverse the provisions recorded in their

books against their full entitled amount according to the Court’s verdict including the legal interest up till December 31,

2021 which is reported as provisions no longer required in the consolidated statement of profit or loss for the year

ended December 31, 2021. The subsidiaries of the group initiated legal execution procedures against those investors

for the fulfillment of that verdict along with its legal interest, which resulted in the collection of almost 78% from the total

amount due to the two subsidiaries till March 31, 2023, whereas the remaining amount is currently under collection by

the Group’s two subsidiaries.

Subsequent to the date of the consolidated interim financial information, as a result of those lawsuits, the defendants

filed a counter-lawsuit against the Parent Company, the two subsidiaries and others demanding for the payment of

AED 261,026,454 (equivalent to KD 21,788,009) in addition to the legal interest of 5% from the date of the judicial claim

till full payment, in addition to demanding payment of AED 50,000,000 (equivalent to KD 4,173,525) as compensation

for lost profits. Subsequently, the court demanded from the plaintiffs in those new legal cases to reregister them at the

concerned judicial department and pay the required additional fees, and hence, it was considered as a closed case till

being reregistered. Hence, there was no need to consider any provisions against that legal case as of the consolidated

interim financial information date.

In addition, subsequent to the date of the consolidated interim financial information, a subsidiary to the Group had

executed a swap deal for its land plots in the United Arab Emirates in exchange for new land plots and rights to purchase

other land plots with the master developer of those plots, where the book value of the disposed plots as of March 31,

2023 has amounted to KD 16,632,732 and the fair value of the new plots and the rights to purchase other plots at the

time of the swap execution has amounted to KD 16,857,545. This transaction will be recognized in the interim

consolidated financial information of the Group in the subsequent interim financial period ending on June 30, 2023.

15