Page 12 - Q1-2023-EN

P. 12

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2023

(All amounts are in Kuwaiti Dinars)

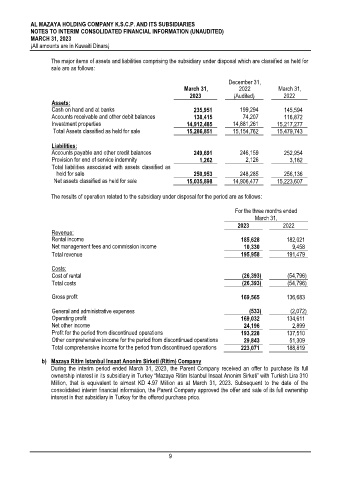

The major items of assets and liabilities comprising the subsidiary under disposal which are classified as held for

sale are as follows:

December 31,

March 31, 2022 March 31,

2023 (Audited) 2022

Assets:

Cash on hand and at banks 235,951 199,294 145,594

Accounts receivable and other debit balances 138,415 74,207 116,872

Investment properties 14,912,485 14,881,261 15,217,277

Total Assets classified as held for sale 15,286,851 15,154,762 15,479,743

Liabilities:

Accounts payable and other credit balances 249,691 246,159 252,954

Provision for end of service indemnity 1,262 2,126 3,182

Total liabilities associated with assets classified as

held for sale 250,953 248,285 256,136

Net assets classified as held for sale 15,035,898 14,906,477 15,223,607

The results of operation related to the subsidiary under disposal for the period are as follows:

For the three months ended

March 31,

2023 2022

Revenue:

Rental income 185,628 182,021

Net management fees and commission income 10,330 9,458

Total revenue 195,958 191,479

Costs:

Cost of rental (26,393) (54,796)

Total costs (26,393) (54,796)

Gross profit 169,565 136,683

General and administrative expenses (533) (2,072)

Operating profit 169,032 134,611

Net other income 24,196 2,899

Profit for the period from discontinued operations 193,228 137,510

Other comprehensive income for the period from discontinued operations 29,843 51,309

Total comprehensive income for the period from discontinued operations 223,071 188,819

b) Mazaya Ritim Istanbul Insaat Anonim Sirketi (Ritim) Company

During the interim period ended March 31, 2023, the Parent Company received an offer to purchase its full

ownership interest in its subsidiary in Turkey “Mazaya Ritim Istanbul Insaat Anonim Sirketi” with Turkish Lira 310

Million, that is equivalent to almost KD 4.97 Million as at March 31, 2023. Subsequent to the date of the

consolidated interim financial information, the Parent Company approved the offer and sale of its full ownership

interest in that subsidiary in Turkey for the offered purchase price.

9