Page 11 - Q1-2023-EN

P. 11

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

MARCH 31, 2023

(All amounts are in Kuwaiti Dinars)

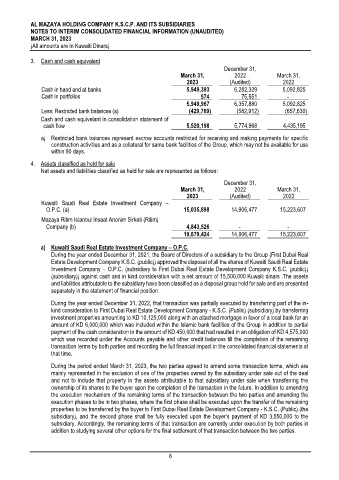

3. Cash and cash equivalent

December 31,

March 31, 2022 March 31,

2023 (Audited) 2022

Cash in hand and at banks 5,949,393 6,282,329 5,092,825

Cash in portfolios 574 75,551 -

5,949,967 6,357,880 5,092,825

Less: Restricted bank balances (a) (429,769) (582,912) (657,630)

Cash and cash equivelant in consolidation statement of

cash flow 5,520,198 5,774,968 4,435,195

a) Restricted bank balances represent escrow accounts restricted for receiving and making payments for specific

construction activities and as a collateral for same bank facilities of the Group, which may not be available for use

within 90 days.

4. Assets classified as held for sale

Net assets and liabilities classified as held for sale are represented as follows:

December 31,

March 31, 2022 March 31,

2023 (Audited) 2022

Kuwaiti Saudi Real Estate Investment Company –

O.P.C. (a) 15,035,898 14,906,477 15,223,607

Mazaya Ritim Istanbul Insaat Anonim Sirketi (Ritim)

Company (b) 4,843,526 - -

19,879,424 14,906,477 15,223,607

a) Kuwaiti Saudi Real Estate Investment Company – O.P.C.

During the year ended December 31, 2021, the Board of Directors of a subsidiary to the Group (First Dubai Real

Estate Development Company K.S.C. (public)) approved the disposal of all the shares of Kuwaiti Saudi Real Estate

Investment Company – O.P.C. (subsidiary to First Dubai Real Estate Development Company K.S.C. (public))

(subsidiary)) against cash and in kind consideration with a net amount of 15,500,000 Kuwaiti dinars .The assets

and liabilities attributable to the subsidiary have been classified as a disposal group held for sale and are presented

separately in the statement of financial position.

During the year ended December 31, 2022, that transaction was partially executed by transferring part of the in-

kind consideration to First Dubai Real Estate Development Company - K.S.C. (Public) (subsidiary) by transferring

investment properties amounting to KD 10,125,000 along with an attached mortgage in favor of a local bank for an

amount of KD 6,000,000 which was included within the Islamic bank facilities of the Group in addition to partial

payment of the cash consideration in the amount of KD 450,000 that had resulted in an obligation of KD 4,575,000

which was recorded under the Accounts payable and other credit balances till the completion of the remaining

transaction terms by both parties and recording the full financial impact in the consolidated financial statements at

that time.

During the period ended March 31, 2023, the two parties agreed to amend some transaction terms, which are

mainly represented in the exclusion of one of the properties owned by the subsidiary under sale out of the deal

and not to include that property in the assets attributable to that subsidiary under sale when transferring the

ownership of its shares to the buyer upon the completion of the transaction in the future. In addition to amending

the execution mechanism of the remaining terms of the transaction between the two parties and amending the

execution phases to be in two phases, where the first phase shall be executed upon the transfer of the remaining

properties to be transferred by the buyer to First Dubai Real Estate Development Company - K.S.C. (Public) (the

subsidiary), and the second phase shall be fully executed upon the buyer’s payment of KD 3,550,000 to the

subsidiary. Accordingly, the remaining terms of that transaction are currently under execution by both parties in

addition to studying several other options for the final settlement of that transaction between the two parties.

8