Page 64 - FS-Q2-2023-EN

P. 64

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

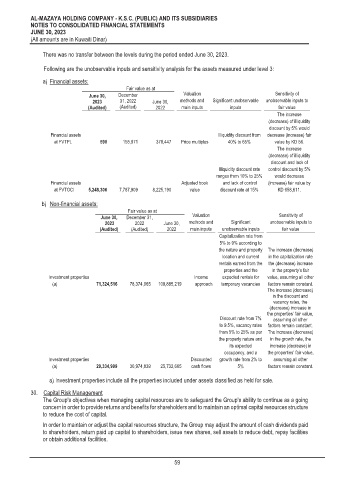

There was no transfer between the levels during the period ended June 30, 2023.

Following are the unobservable inputs and sensitivity analysis for the assets measured under level 3:

a) Financial assets:

Fair value as at

June 30, December Valuation Sensitivity of

2023 31, 2022 June 30, methods and Significant unobservable unobservable inputs to

(Audited) (Audited) 2022 main inputs inputs fair value

The increase

(decrease) of illiquidity

discount by 5% would

Financial assets Illiquidity discount from decrease (increase) fair

at FVTPL 590 155,971 378,447 Price multiples 40% to 65% value by KD 56.

The increase

(decrease) of illiquidity

discount and lack of

Illiquidity discount rate control discount by 5%

ranges from 10% to 25% would decrease

Financial assets Adjusted book and lack of control (increase) fair value by

at FVTOCI 5,248,306 7,787,909 8,225,190 value discount rate at 15% KD 658,611.

b) Non-financial assets:

Fair value as at

June 30, December 31, Valuation Sensitivity of

2023 2022 June 30, methods and Significant unobservable inputs to

(Audited) (Audited) 2022 main inputs unobservable inputs fair value

Capitalization rate from

5% to 9% according to

the nature and property The increase (decrease)

location and current in the capitalization rate

rentals earned from the the (decrease) increase

properties and the in the property’s fair

Investment properties Income expected rentals for value, assuming all other

(a) 71,324,516 78,374,965 109,885,219 approach temporary vacancies factors remain constant.

The increase (decrease)

in the discount and

vacancy rates, the

(decrease) increase in

the properties’ fair value,

Discount rate from 7% assuming all other

to 9.5%, vacancy rates factors remain constant.

from 5% to 25% as per The increase (decrease)

the property nature and in the growth rate, the

its expected increase (decrease) in

occupancy, and a the properties’ fair value,

Investment properties Discounted growth rate from 2% to assuming all other

(a) 29,334,999 30,974,839 25,732,665 cash flows 5% factors remain constant.

a) Investment properties include all the properties included under assets classified as held for sale.

30. Capital Risk Management

The Group's objectives when managing capital resources are to safeguard the Group's ability to continue as a going

concern in order to provide returns and benefits for shareholders and to maintain an optimal capital resources structure

to reduce the cost of capital.

In order to maintain or adjust the capital resources structure, the Group may adjust the amount of cash dividends paid

to shareholders, return paid up capital to shareholders, issue new shares, sell assets to reduce debt, repay facilities

or obtain additional facilities.

59