Page 17 - Q3-2024-EN

P. 17

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2023

(All amounts are in Kuwaiti Dinars)

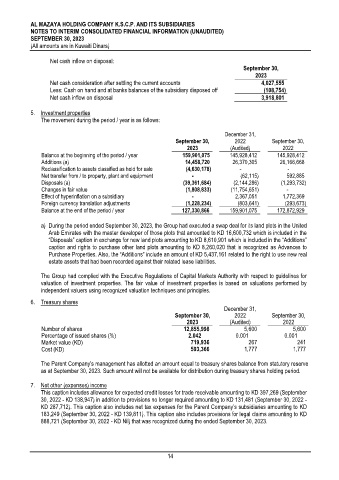

Net cash inflow on disposal:

September 30,

2023

Net cash consideration after settling the current accounts 4,027,555

Less: Cash on hand and at banks balances of the subsidiary disposed off (108,754)

Net cash inflow on disposal 3,918,801

5. Investment properties

The movement during the period / year is as follows:

December 31,

September 30, 2022 September 30,

2023 (Audited) 2022

Balance at the beginning of the period / year 159,901,075 145,928,412 145,928,412

Additions (a) 14,458,720 26,370,305 26,166,668

Reclassification to assets classified as held for sale (4,630,178) - -

Net transfer from / to property, plant and equipment - (62,115) 592,885

Disposals (a) (39,361,684) (2,144,286) (1,293,732)

Changes in fair value (1,808,833) (11,754,651) -

Effect of hyperinflation on a subsidiary - 2,367,051 1,772,369

Foreign currency translation adjustments (1,228,234) (803,641) (293,673)

Balance at the end of the period / year 127,330,866 159,901,075 172,872,929

a) During the period ended September 30, 2023, the Group had executed a swap deal for its land plots in the United

Arab Emirates with the master developer of those plots that amounted to KD 16,600,732 which is included in the

“Disposals” caption in exchange for new land plots amounting to KD 8,610,901 which is included in the “Additions”

caption and rights to purchase other land plots amounting to KD 8,260,020 that is recognized as Advances to

Purchase Properties. Also, the “Additions” include an amount of KD 5,437,161 related to the right to use new real

estate assets that had been recorded against their related lease liabilities.

The Group had complied with the Executive Regulations of Capital Markets Authority with respect to guidelines for

valuation of investment properties. The fair value of investment properties is based on valuations performed by

independent valuers using recognized valuation techniques and principles.

6. Treasury shares

December 31,

September 30, 2022 September 30,

2023 (Audited) 2022

Number of shares 12,855,998 5,600 5,600

Percentage of issued shares (%) 2.042 0.001 0.001

Market value (KD) 719,936 267 241

Cost (KD) 593,366 1,777 1,777

The Parent Company's management has allotted an amount equal to treasury shares balance from statutory reserve

as at September 30, 2023. Such amount will not be available for distribution during treasury shares holding period.

7. Net other (expenses) income

This caption includes allowance for expected credit losses for trade receivable amounting to KD 397,269 (September

30, 2022 - KD 138,947) in addition to provisions no longer required amounting to KD 131,481 (September 30, 2022 -

KD 287,712). This caption also includes net tax expenses for the Parent Company’s subsidiaries amounting to KD

183,249 (September 30, 2022 - KD 139,811). This caption also includes provisions for legal claims amounting to KD

888,721 (September 30, 2022 - KD Nil) that was recognized during the ended September 30, 2023.

14