Page 14 - Q3-2024-EN

P. 14

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

SEPTEMBER 30, 2023

(All amounts are in Kuwaiti Dinars)

Subsequent to the date of the interim consolidated financial information, the two parties signed a termination and

settlement agreement for this transaction due to the second party’s failure (the buyer) to fulfill his remaining obligations

to complete the deal, which led the two parties to terminate the deal and agree on a final settlement which includes the

buyer’s undertaking to assume a bank debt amounting to KD 4,000,000 relating to the properties previously transferred

to First Dubai Real Estate Development Company - K.S.C. (Public) (a subsidiary), in addition to the payment of KD

150,000 to the parent company within one year period from signing the termination and settlement agreement as a final

settlement between the two parties. On the other hand, the parent company shall retransfer back to the buyer the

ownership of the properties subject to that settlement which were previously transferred to it within the terms of this

transaction. The termination of that transaction will result in the reclassification of the assets classified as held for sale

and their related liabilities back to the group’s assets and liabilities, as well as reclassifying the results of operations

pertaining to Kuwaiti Saudi Real Estate Investment Company - O.P.C. within the continuing operations, in addition to

excluding the liabilities and the properties related to that transaction from the company’s financial statements when

those properties’ ownership is transferred to the buyer. The impact of these transactions will be included in the

company’s consolidated financial statements in the fiscal period where the procedures for transferring ownership of

those properties subject to settlement are finalized.

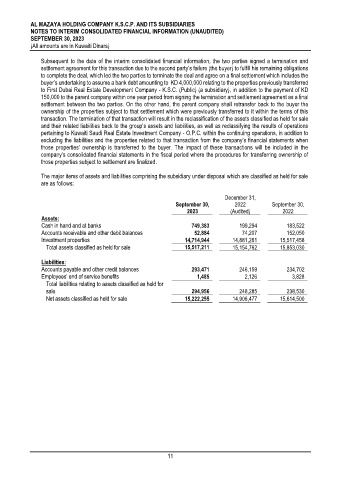

The major items of assets and liabilities comprising the subsidiary under disposal which are classified as held for sale

are as follows:

December 31,

September 30, 2022 September 30,

2023 (Audited) 2022

Assets:

Cash in hand and at banks 749,383 199,294 183,522

Accounts receivable and other debit balances 52,884 74,207 152,050

Investment properties 14,714,944 14,881,261 15,517,458

Total assets classified as held for sale 15,517,211 15,154,762 15,853,030

Liabilities:

Accounts payable and other credit balances 293,471 246,159 234,702

Employees’ end of service benefits 1,485 2,126 3,828

Total liabilities relating to assets classified as held for

sale 294,956 248,285 238,530

Net assets classified as held for sale 15,222,255 14,906,477 15,614,500

11