ANNUAL REPORT

2015

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2015

Description of significant unobservable inputs to valuation of financial assets:

Managed portfolio and funds have been valued based on Net Asset Value (NAV) provided by the custodian of the fund. The

information relating to valuation techniques and significant unobservable inputs to valuation to compute the sensitivity of the fair

value measurement to changes in unobservable inputs in not available.

Non-financial assets

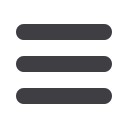

Investment properties were classified under level 2 and level 3 fair value hierarchy as follows:

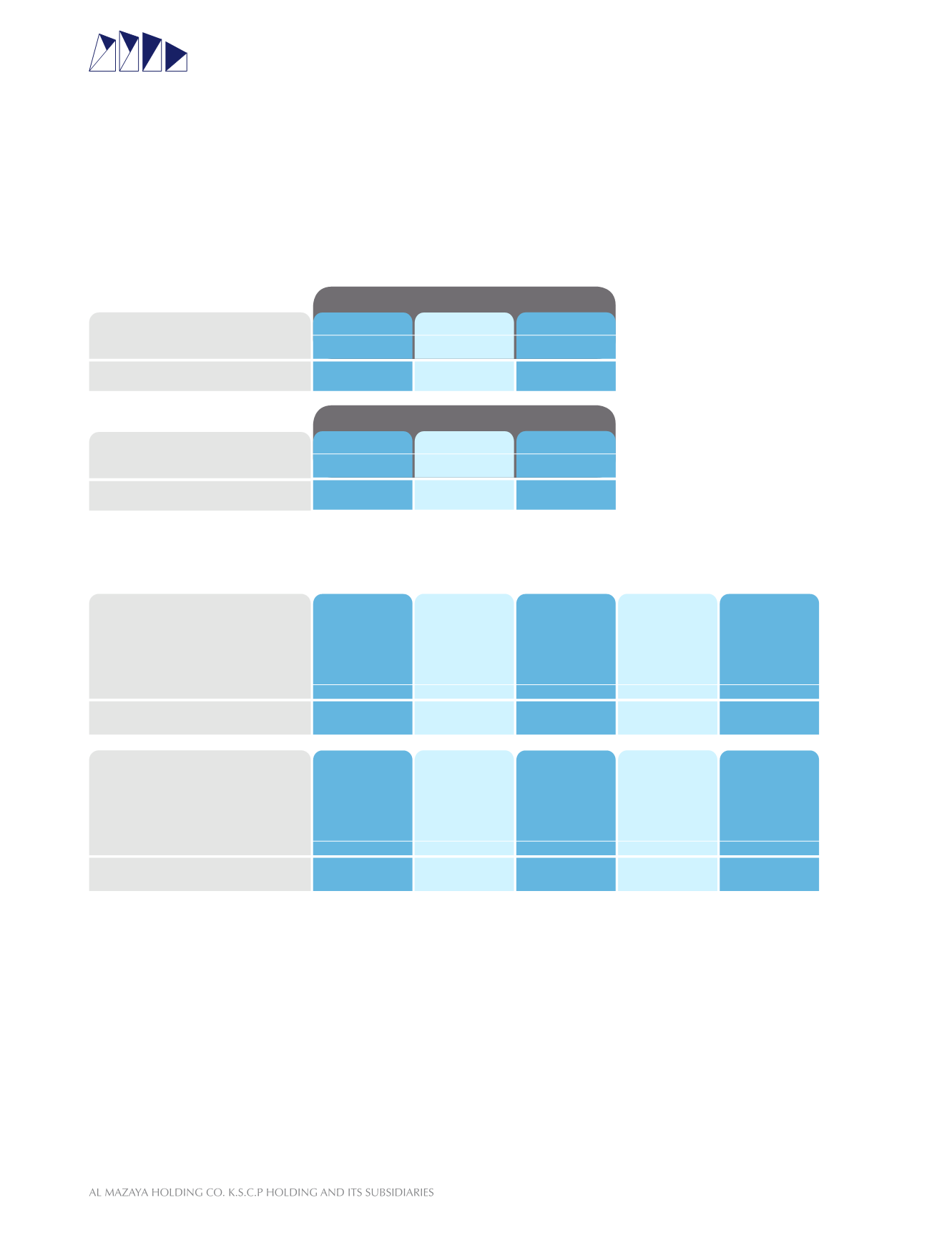

The following table shows a reconciliation of the opening and closing amount of level 3 non-financial assets which are recorded

at fair value.

Fair value of investment properties were determined using Mark to Market method and capitalisation of rental income method.

The fair valuation was conducted by valuators considering transaction prices of similar properties in case of Mark to Market

method. The significant unobservable valuation input used is the market price per square foot and varies from property to property.

A reasonable change in this input would result in an equivalent amount of change in fair value.

Capitalisation of rental income method assumes capitalisation of annual rental income and the significant unobservable valuation

input used is the capitalisation rate in the range of 5.8% to 7% (2014: 5.8% to 9.5%). A 5% increase in this input would result in

an equivalent decrease in fair value.

Certain investment properties owned by the Group on Build Operate and Transfer (BOT) basis are valued using discounted cash

flow method.

86

2015

2014

155,006,585

92,312,256

Level 2

KD

Level 2

KD

Investment properties

Investment properties

Level 3

KD

Level 3

KD

Total

KD

Total

KD

50,553,670

41,814,250

64,452,915

50,498,006

11,659,025

)1,148,100(

At 1 January

2015

KD

At 1 January

2014

KD

Gain

recorded in the

consolidated

statement of

income

KD

Loss

recorded in the

consolidated

statement of

income

KD

Gain recorded

in other

comprehensive

income

KD

Gain recorded

in other

comprehensive

income

KD

Net

purchases,

sales and

settlements

KD

Net

purchases,

sales and

settlements

KD

At

31 December

2015

KD

At

31 December

2014

KD

423,536

)392,292(

50,498,006

50,634,871

1,872,348

1,403,527

64,452,915

50,498,006

Investment properties

Investment properties