ANNUAL REPORT

2015

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2015

22. NET MANAGEMENT FEES AND COMMISSION INCOME

2015

KD

8,837,008

1,267,692

59,974

211,192

1,645,413

3,878,957

15,900,236

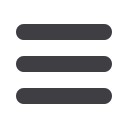

Trade payables

Retentions payable

Accrued development costs

Dividends payable

Due to related parties (Note 24)

Other payables and accrued expenses

2014

KD

4,013,789

1,606,979

59,974

166,450

-

3,284,494

9,131,686

2015

KD

477,064

(98,234)

378,830

Management fees and commission income

Cost of management fees and commission

income

2014

KD

658,863

(265,647)

393,216

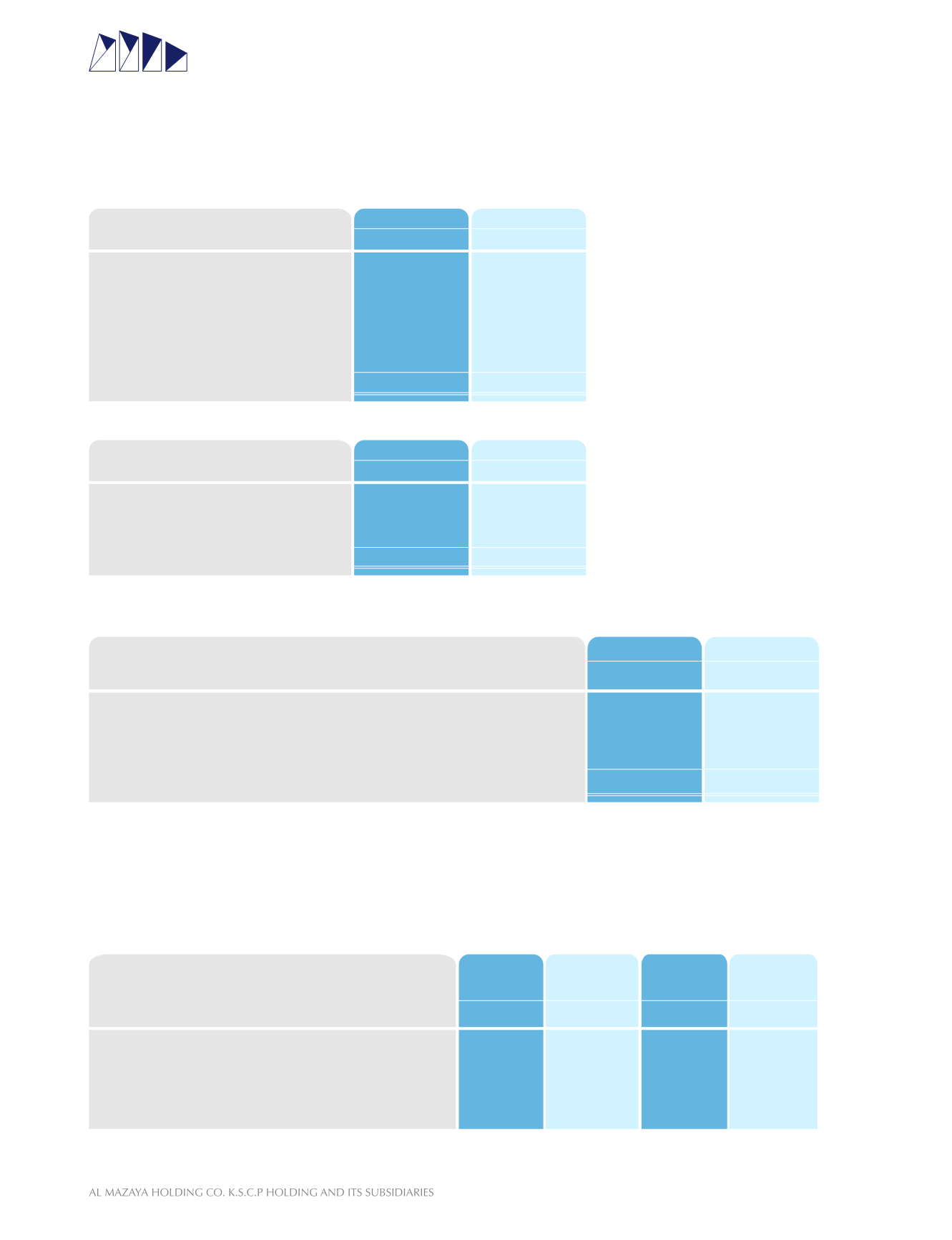

23. NET INVESTMENT INCOME

24. RELATED PARTY TRANSACTIONS

These represent transactions with related parties, i.e. subsidiaries, shareholders, directors and key management personnel of the

Group, and entities controlled, jointly controlled or significantly influenced by such parties. Pricing policies and terms of these

transactions are approved by the Group’s management.

Transactions with related parties included in the consolidated financial statement are as follows:

i) Amounts due from/to related parties are interest free and are receivable or payable on demand.

324

127,075

)61,039(

)54,947(

11,413

1,675,547

104,381

)126,637(

)61,904(

1,591,387

Realized gain on disposal of financial assets available for sale

Dividend income

Portfolio management fees

Impairment loss on financial assets available for sale (Note 11)

2014

KD

2015

KD

21. ACCOUNTS PAYABLE AND OTHER LIABILITIES

495,936

1,579,374

-

1,043,844

66,039

11,933,090

1,539,780

1,645,413

11,933,090

1,761,850

-

14,656,980

Consolidated statement of financial position:

Accounts receivable and other debit balances (Note 14) (Note i)

Accounts payable and other credit balances (Note 21) (Note i)

Advances for purchase of properties (Note 12)

Major

shareholders

KD

Joint venture

and associates

KD

2015

KD

2014

KD

80