Page 17 - Mazaya Holding_FS_E_Q2_2021

P. 17

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

NOTES TO INTERIM CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED)

JUNE 30, 2021

(All amounts are in Kuwaiti Dinars)

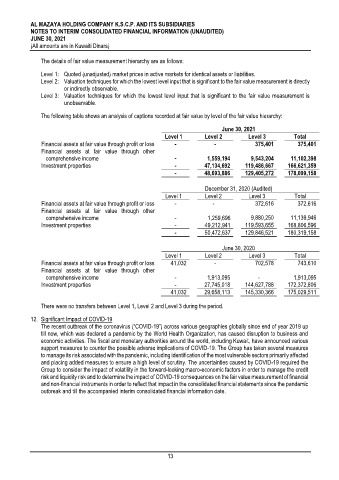

The details of fair value measurement hierarchy are as follows:

Level 1: Quoted (unadjusted) market prices in active markets for identical assets or liabilities.

Level 2: Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly

or indirectly observable.

Level 3: Valuation techniques for which the lowest level input that is significant to the fair value measurement is

unobservable.

The following table shows an analysis of captions recorded at fair value by level of the fair value hierarchy:

June 30, 2021

Level 1 Level 2 Level 3 Total

Financial assets at fair value through profit or loss - - 375,401 375,401

Financial assets at fair value through other

comprehensive income - 1,559,194 9,543,204 11,102,398

Investment properties - 47,134,692 119,486,667 166,621,359

- 48,693,886 129,405,272 178,099,158

December 31, 2020 (Audited)

Level 1 Level 2 Level 3 Total

Financial assets at fair value through profit or loss - - 372,616 372,616

Financial assets at fair value through other

comprehensive income - 1,259,696 9,880,250 11,139,946

Investment properties - 49,212,941 119,593,655 168,806,596

- 50,472,637 129,846,521 180,319,158

June 30, 2020

Level 1 Level 2 Level 3 Total

Financial assets at fair value through profit or loss 41,032 - 702,578 743,610

Financial assets at fair value through other

comprehensive income - 1,913,095 - 1,913,095

Investment properties - 27,745,018 144,627,788 172,372,806

41,032 29,658,113 145,330,366 175,029,511

There were no transfers between Level 1, Level 2 and Level 3 during the period.

12. Significant Impact of COVID-19

The recent outbreak of the coronavirus (“COVID-19”) across various geographies globally since end of year 2019 up

till now, which was declared a pandemic by the World Health Organization, has caused disruption to business and

economic activities. The fiscal and monetary authorities around the world, including Kuwait, have announced various

support measures to counter the possible adverse implications of COVID-19. The Group has taken several measures

to manage its risk associated with the pandemic, including identification of the most vulnerable sectors primarily affected

and placing added measures to ensure a high level of scrutiny. The uncertainties caused by COVID-19 required the

Group to consider the impact of volatility in the forward-looking macro-economic factors in order to manage the credit

risk and liquidity risk and to determine the impact of COVID-19 consequences on the fair value measurement of financial

and non-financial instruments in order to reflect that impact in the consolidated financial statements since the pandemic

outbreak and till the accompanied interim consolidated financial information date.

13