Page 43 - FS-Q2-2023-EN

P. 43

AL-MAZAYA HOLDING COMPANY - K.S.C. (PUBLIC)

AND ITS SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

(All amounts are in Kuwaiti Dinar)

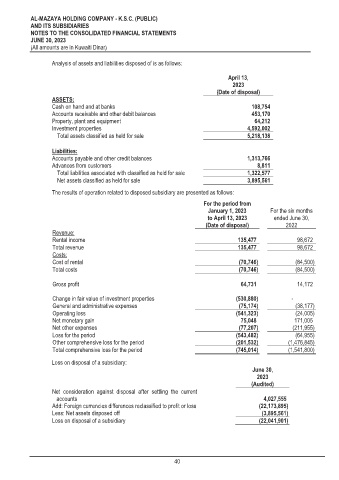

Analysis of assets and liabilities disposed of is as follows:

April 13,

2023

(Date of disposal)

ASSETS:

Cash on hand and at banks 108,754

Accounts receivable and other debit balances 453,170

Property, plant and equipment 64,212

Investment properties 4,592,002

Total assets classified as held for sale 5,218,138

Liabilities:

Accounts payable and other credit balances 1,313,766

Advances from customers 8,811

Total liabilities associated with classified as held for sale 1,322,577

Net assets classified as held for sale 3,895,561

The results of operation related to disposed subsidiary are presented as follows:

For the period from

January 1, 2023 For the six months

to April 13, 2023 ended June 30,

(Date of disposal) 2022

Revenue:

Rental income 135,477 98,672

Total revenue 135,477 98,672

Costs:

Cost of rental (70,746) (84,500)

Total costs (70,746) (84,500)

Gross profit 64,731 14,172

Change in fair value of investment properties (530,880) -

General and administrative expenses (75,174) (38,177)

Operating loss (541,323) (24,005)

Net monetary gain 75,048 171,005

Net other expenses (77,207) (211,955)

Loss for the period (543,482) (64,955)

Other comprehensive loss for the period (201,532) (1,476,845)

Total comprehensive loss for the period (745,014) (1,541,800)

Loss on disposal of a subsidiary:

June 30,

2023

(Audited)

Net consideration against disposal after settling the current

accounts 4,027,555

Add: Foreign currencies differences reclassified to profit or loss (22,173,895)

Less: Net assets disposed off (3,895,561)

Loss on disposal of a subsidiary (22,041,901)

40