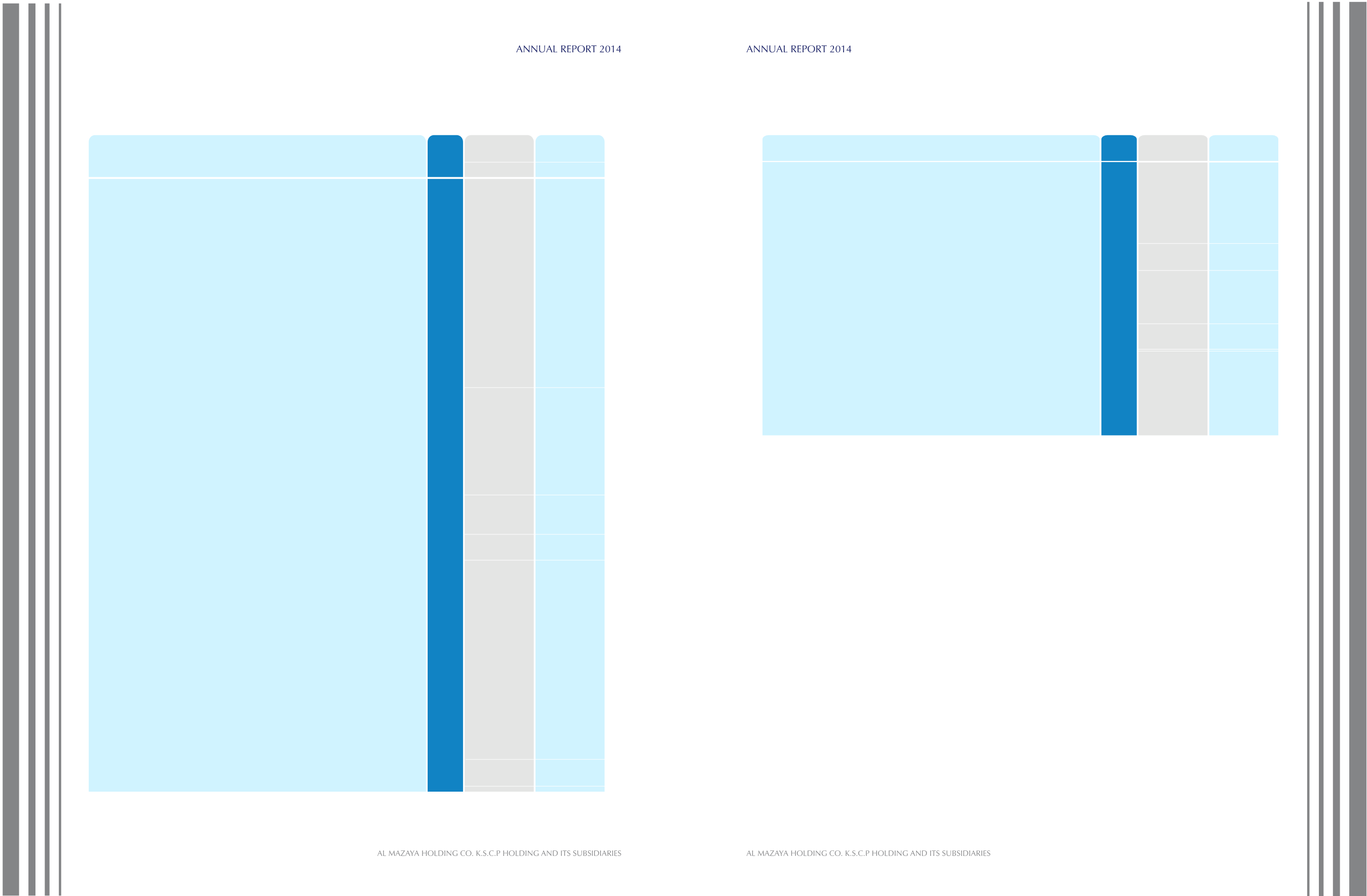

6,939,357

63,944

2,634,303

)5,083,148(

)126,271(

)704,717(

484,641

)309,765(

)26,052(

)75,837(

2,691

83,340

3,882,486

8,342,128

)116,561(

)5,196,133(

)3,947,108(

6,592,819

9,557,631

)43,040(

9,514,591

62,486

)261,737(

)10,149,170(

-

826,360

3,936,112

262,932

-

577,510

1,904,159

297,880

5,000

75,837

)2,462,631(

8

13

23

9,10

10

8

9

9

12

9

23

2014

KD

2013

KD

Notes

OPERATING ACTIVITIES

Profit for the year before contribution for directors’ remuneration,

KFAS, Zakat and NLST

Adjustments to reconcile profit to net cash flows:

Depreciation

Finance costs

Net change in fair value of investment properties

Gain on disposal of investment properties

Write back of impairment loss on properties held for trading

Net investment (income) loss

Share of results from joint venture and associate

Gain on disposal of an associate

Interest income

Foreign exchange loss

Provision for employees’ end of service benefits

Working capital adjustments:

Properties held for trading

Accounts receivable and other debit balances

Accounts payable and other credit balances

Deferred consideration on acquisition of properties

Advances from customers

Cash flows (used in) from operations

Employees’ end of service benefits paid

Net cash flows (used in) from operating activities

INVESTING ACTIVITIES

(Increase) decrease in restricted cash balances

Purchase of property and equipment

Addition to investment properties

Investment in joint venture

Proceeds from disposal of investment properties

Movement in current account with joint venture

Proceeds from sale of financial assets available for sale

Advances for purchase of properties

Proceeds from partial disposal of an associate

Proceeds from partial disposal of a subsidiary

Dividend received from an associate

Dividends income received

Interest income received

Net cash flows used in investing activities

9,142,128

122,112

2,539,603

1,199,949

)202,728(

)2,003,838(

)1,591,387(

)1,628,667(

)2,928,815(

)55,302(

31,892

286,242

4,911,189

)10,361,448(

)4,317,244(

)4,349,027(

-

10,994,179

)3,122,351(

)77,445(

)3,199,796(

)3,999,840(

)381,586(

)5,890,258(

)3,702,816(

3,079,179

1,244,833

7,469,884

)16,817,022(

2,793,215

437,874

287,019

104,381

55,302

)15,319,835(

Consolidated Statement of Cash Flow

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

For the year ended 31 December 2014

The attached notes 1 to 31 form part of these consolidated financial information.

48

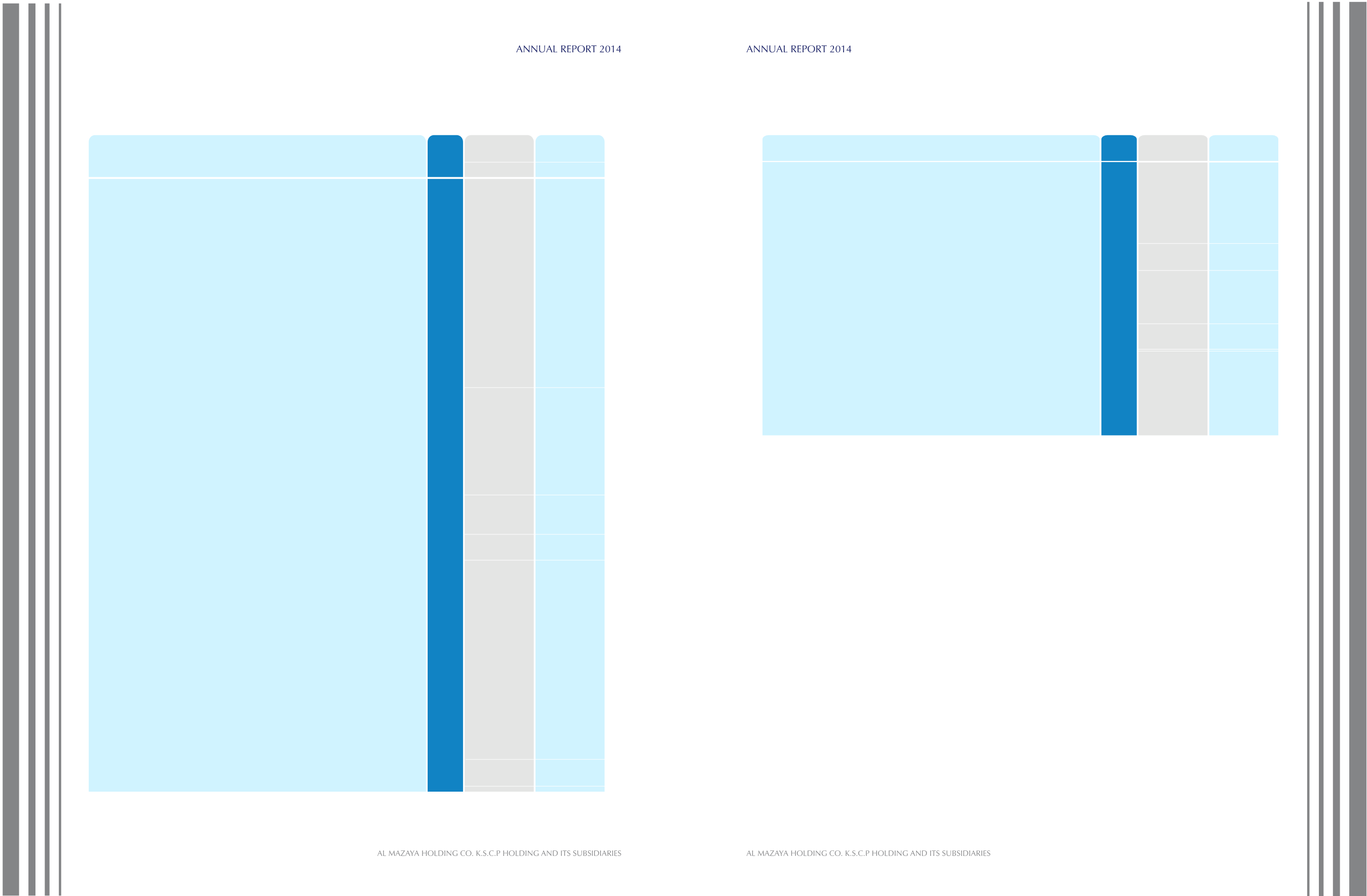

15

)11,000,000(

29,361,214

)2,090,278(

16,270,936

)2,248,695(

108,322

8,311,357

6,170,984

)14,500,000(

14,397,300

)2,634,303(

)2,737,003(

4,314,957

)269,887(

4,266,287

8,311,357

FINANCING ACTIVITIES

Term loans repaid

Net movement in tawarruq and ijara payables

Finance costs paid

Net cash flows from (used in) financing activities

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS

Foreign currency translation adjustments

Cash and cash equivalents at the beginning of the year

CASH AND CASH EQUIVALENTS AT THE END OF THE YEAR

2014

KD

2013

KD

Notes

The attached notes 1 to 31 form part of these consolidated financial information.

Consolidated Statement of Cash Flow

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

For the year ended 31 December 2014

49