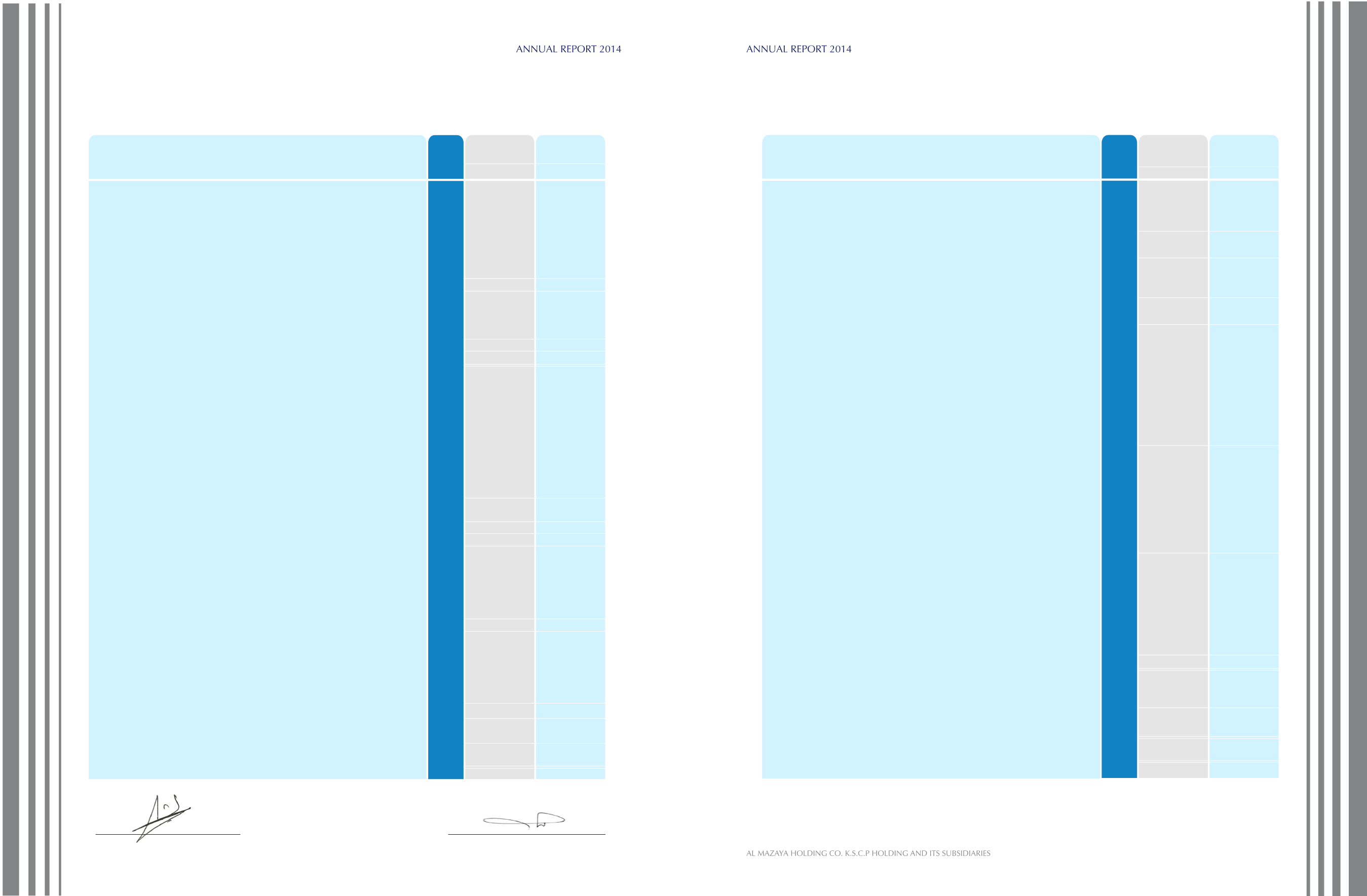

2,266,732

618,180

92,312,256

12,884,446

12,072,697

16,817,022

136,971,333

98,751,223

9,848,399

16,317,680

124,917,302

261,888,635

68,827,896

21,655,393

11,136,621

8,201,701

1,340,732

)21,788,181(

845,160

2,096,107

8,294,866

100,610,295

7,145,155

107,755,450

586,008

8,000,000

48,254,413

56,840,421

4,500,000

4,004,101

79,656,977

9,131,686

-

97,292,764

154,133,185

261,888,635

2,266,732

358,706

89,094,871

14,250,135

12,750,873

-

118,721,317

86,385,937

5,563,047

17,445,840

109,394,824

228,116,141

64,931,977

21,655,393

10,289,898

7,354,978

1,408,173

)21,788,181(

673,551

636,546

5,797,886

90,960,221

6,207,117

97,167,338

377,211

22,000,000

20,497,705

42,874,916

1,500,000

2,399,595

68,662,798

12,523,867

2,987,627

88,073,887

130,948,803

228,116,141

7

8

9,10

11

12

13

14

15

16

16

17

17

18

19

20

19

20

21

15

2014

KD

ASSETS

Non-current assets

Goodwill

Property and equipment

Investment properties

Investment in joint ventures and associates

Financial assets available for sale

Advances for purchase of properties

Current assets

Properties held for trading

Accounts receivable and other debit balances

Cash and cash equivalents

Total assets

EQUITY AND LIABILITIES

Equity

Share capital

Share premium

Statutory reserve

Voluntary reserve

Fair value reserve

Treasury shares

Other reserves

Foreign currency translation reserve

Retained earnings

Equity attributable to equity holders of the Parent Company

Non-controlling interests

Total equity

Liabilities

Non-current liabilities

Employees’ end of service benefits

Term loans

Tawarruq and ijara payables

Current liabilities

Term loans

Tawarruq and ijara payables

Advances from customers

Accounts payable and other credit balances

Bank overdrafts

Total liabilities

TOTAL LIABILITIES AND EQUITY

2013

KD

Notes

Rasheed Y. Al-Nafisi – Chairman

Ibrahim A. AlSoqabi – Group CEO

Consolidated Statement of Financial Position

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

At 31 December 2014

The attached notes 1 to 31 form part of these consolidated financial information.

44

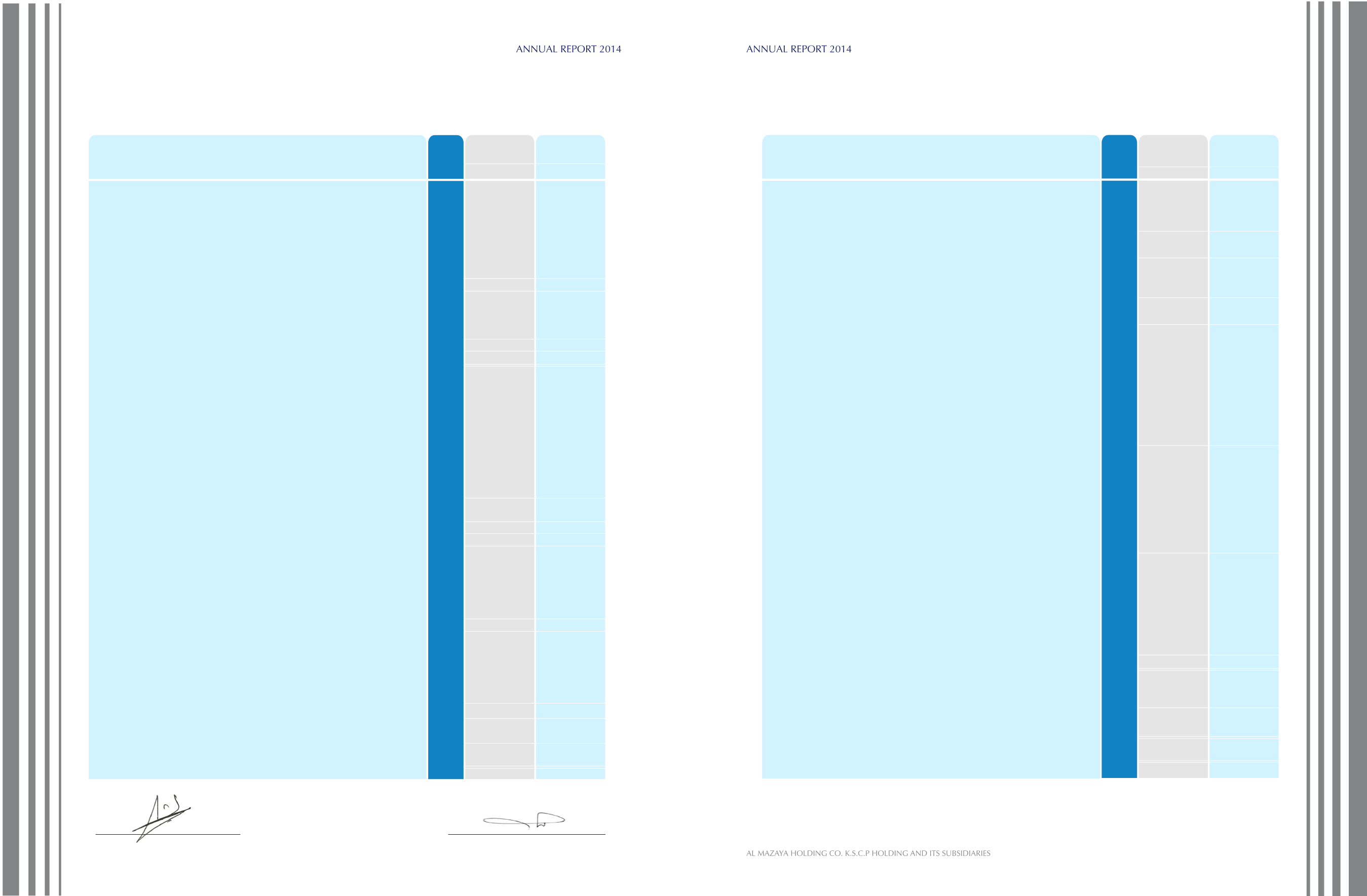

22

8

9,10

10

13

23

24

16

6

2014

KD

2013

KD

Revenue from sale of properties held for trading

Rental income

Net management fees and commission income

REVENUE

Cost of sale of properties held for trading

Cost of rental

COST OF REVENUE

GROSS PROFIT

Net change in fair value of investment properties

Gain on disposal of investment properties

Share of results of joint ventures and associates

Gain on disposal of an associate

Write back of impairment loss on properties held for trading

General and administrative expenses

OPERATING INCOME

Net investment income (loss)

Other income (expense)

Interest income

Finance costs

Foreign exchange loss

Profit for the year before contribution for board of directors’ remuneration,

Kuwait Foundation for Advancement of Sciences (“KFAS”), National

Labour Support Tax (“NLST”) and Zakat

Board of Directors’ Remuneration

KFAS

Zakat

NLST

Attributable to:

Equity holders of the Parent Company

Non-controlling interests

PROFIT FOR THE YEAR

BASIC AND DILUTED EARNING PER SHARE ATTRIBUTABLE TO EQUITY

HOLDERS OF THE PARENT COMPANY

The attached notes 1 to 31 form part of these consolidated financial information.

10,968,894

5,302,786

393,216

16,664,896

)9,168,087(

)1,229,322(

)10,397,409(

6,267,487

)1,199,949(

202,728

1,628,667

2,928,815

2,003,838

(3,997,903)

7,833,683

1,591,387

2,233,251

55,302

(2,539,603)

(31,892)

9,142,128

(120,000)

(76,069)

(50,076)

(134,739)

8,761,244

8,086,345

674,899

8,761,244

13.05 fils

21,401,278

3,964,882

609,780

25,975,940

)17,070,175(

)1,119,465(

)18,189,640(

7,786,300

5,083,148

126,271

309,765

26,052

704,717

(3,459,447)

10,576,806

(484,641)

(591,651)

75,837

(2,634,303)

(2,691)

6,939,357

(85,000)

(55,129)

-

-

6,799,228

6,001,051

798,177

6,799,228

9.69 fils

Notes

Consolidated Statement of Income

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

For the year ended 31 December 2014

45