Notes to The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C. (HOLDING) AND ITS SUBSIDIARIES

For the year ended 31 December 2011

36

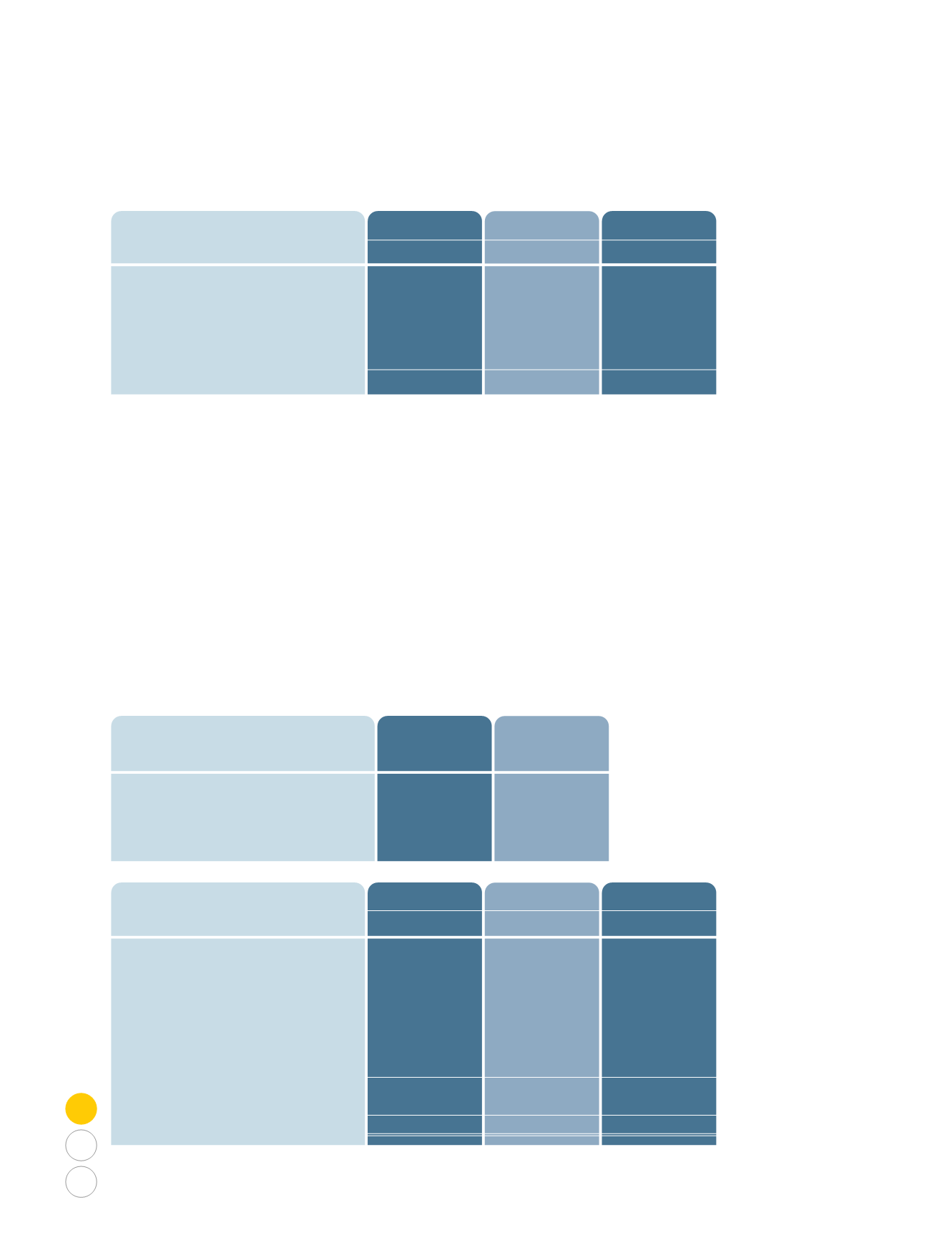

9. AVAILABLE FOR SALE INVESTMENTS

1,980,122

4,580,179

9,774,316

16,334,617

2,496,543

4,419,702

11,490,663

18,406,908

1,393,094

17,235,067

6,085,331

24,713,492

2011

KD

2010

KD

2009

KD

Quoted:

Equity securities

Unquoted:

Equity securities

Funds & Portfolios

Available for sale investments with a fair value of KD 3,398,445 (31 December 2010: KD 13,340,787, 31 December 2009:

Nil) are pledged against loans disclosed in note 14.

Available for sale investments with a fair value of KD Nil (31 December 2010: 2,525,102, 31 December 2009: Nil) are

pledged against a related party payable disclosed in note 13.

Available for sale investments amounting to KD 702,883 (2010: Nil, 2009: KD 631,575) are carried at cost since the fair

value could not be reliably determined.

Impairment loss on available for sale investments of KD 455,904 (2010: KD 4,156,488, 2009: KD Nil) has been recognized

in the consolidated statement of income.

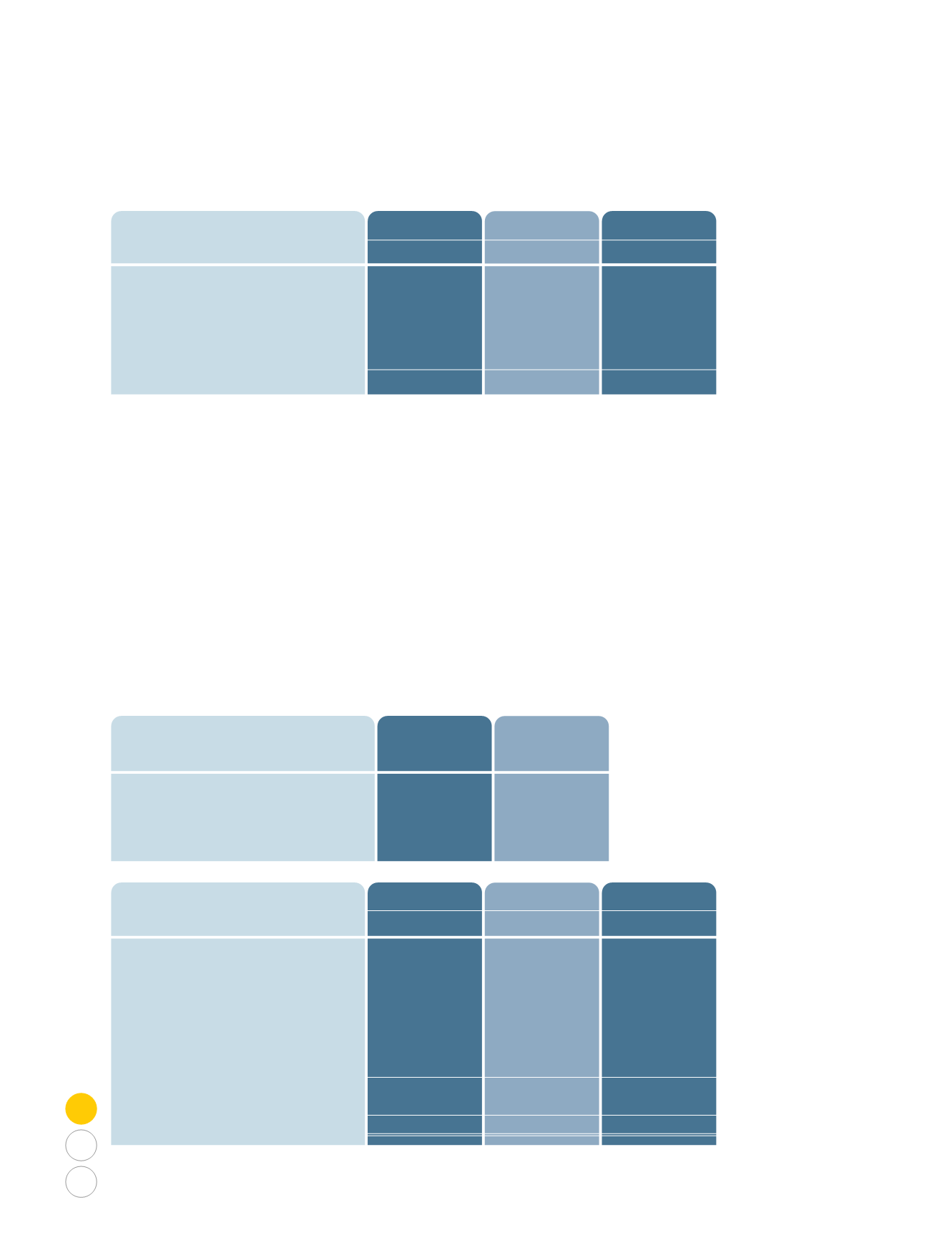

10. INVESTMENT IN ASSOCIATES

The group exercises significant influence over the operating and financial policies of First Qatar Real Estate Development

K.S.C (closed) through the group’s representation in the BOD of the company. Group also exercises significant influence

over Mazaya Qatar Real Estate Development Q.S.C through management agreement that enables the Group to participate

and influence the company’s operating and financial policies.

Qatar

Kuwait

Jordan

Mazaya Qatar Real Estate Development Q.S.C

First Qatar Real Estate Development

K.S.C.(Closed)

Real Estate Development J.S.C.

6.37

17.54

-

Country of

incorporation

Ownership

Percentage

11,247,105

8,569,475

418,187

(493,477)

(6,129,727)

134,620

-

13,746,183

(482,380)

13,263,803

3,905,889

6,676,330

615,920

48,811

-

-

155

11,247,105

(832,281)

10,414,824

13,746,183

-

670,000

(148,010)

-

-

(193,996)

14,074,177

(505,523)

13,568,654

Balance at the beginning of the year

Transferred from Investment available for sale

Additions

Group’s share of results for the year

Disposal

Dilution gain

Foreign currency translation adjustments

Provision

Balance at the end of the year

2011

KD

2010

KD

2009

KD