ANNUAL REPORT

2016

N

otes To The Consolidated Financial Statements

AL MAZAYA HOLDING K.S.C.P. AND ITS SUBSIDIARIES

As At 31 December 2016

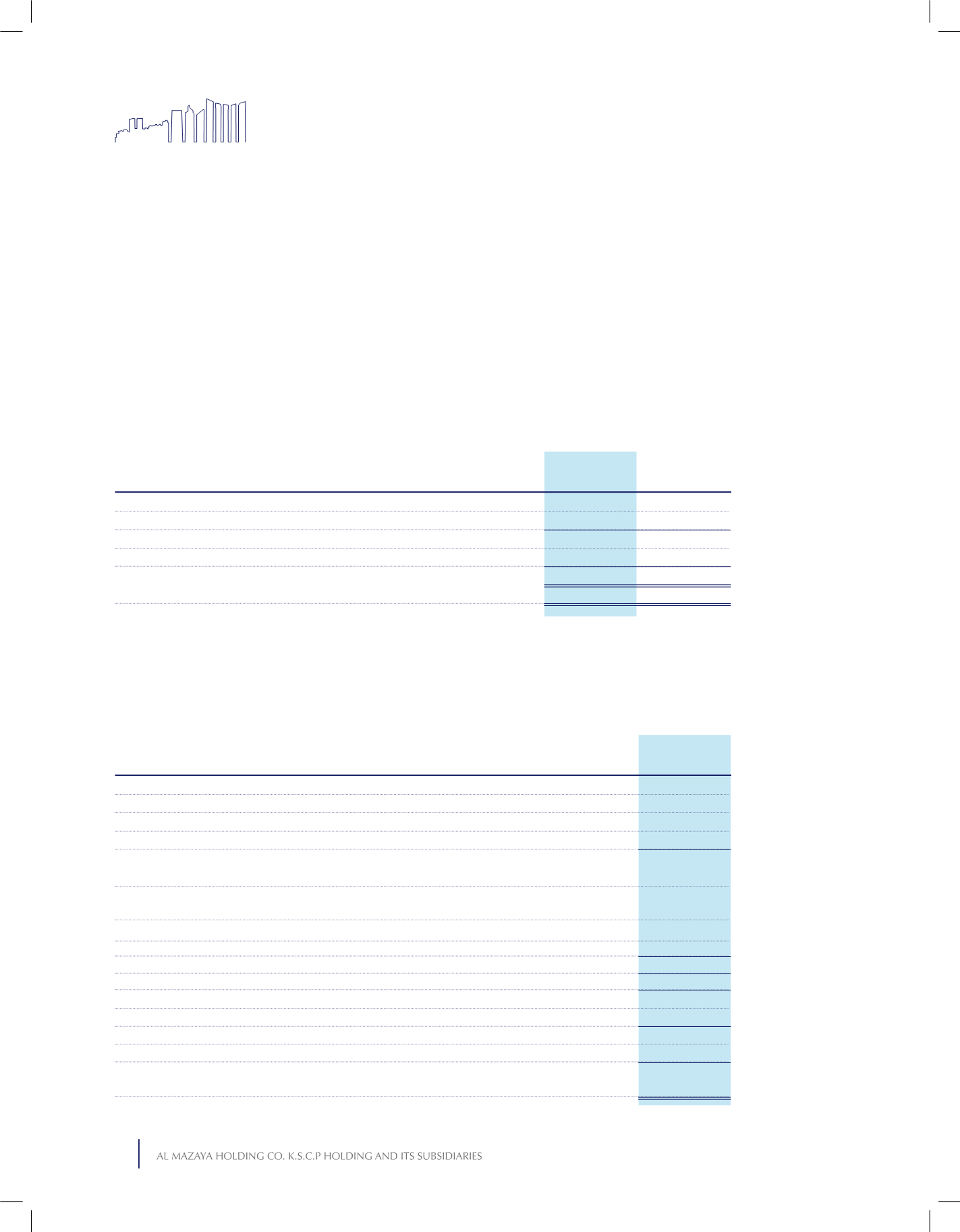

31. CAPITAL MANAGEMENT

The primary objective of the Group’s capital management is to ensure that it maintains healthy capital ratios in order

to support its business to maximise shareholder value and remain within the quantitative covenants of bank facilities.

The Group manages and adjusts its capital structure in light of changes in economic conditions. To maintain or adjust

the capital structure, the Group may adjust the dividend payment to shareholders, return capital to shareholders, issue

new shares and obtain or settle bank facilities. No changes were made in the objectives, policies or processes during

the year ended 31 December 2016 and 2015.

The Group monitors capital using a gearing ratio as per the debt covenant for their bank facilities, which is net debt

divided by total equity plus net debt. The Group’s policy is to keep the gearing ratio below 60%. The Group includes

within net debt, ijara payable, tawarruq payable less cash and bank balances. The Group considers equity as shown

in the consolidated statement of financial position.

32. SALE OF SUBSIDIARY

On 11 February 2016, one of the Group’s subsidiaries sold its 100% equity interest in Gulf Turkey Gayimenkul

Yatirimlarianonim Sirketi (“GTGYS”) for a total consideration of KD 16,364,294 to Ritim. The sale of GTGYS resulted

in a gain of KD 1,184,979 net of downstream elimination recognised in the consolidated statement of income.

The details of the consideration paid and the fair values of the assets and liabilities sold, equivalent to their carrying

values, are summarised as follows:

Debts

Less: cash and bank balances

Net debt

Equity

Equity and net debt

Gearing Ratio

Assets

Advances for purchase of properties

Other receivables

Cash and bank balances

Total assets transferred

Liabilities

Other payables

Amount due to related parties

Total liabilities transferred

Net assets transferred

Consideration received

Foreign currency translation reserve

Gain on sale of a subsidiary

Less: adjustment for upstream/down-stream transaction

Net gain on sale of a subsidiary

86,636,199

)6,023,890(

80,612,309

119,608,277

200,220,586

40.26%

80,366,446

)1,930,983(

78,435,463

111,454,343

189,889,806

41.31%

12,119,942

501

1,102

12,121,545

)312(

)445,671(

)445,983(

11,675,562

16,364,294

)3,094,556(

1,594,176

)409,197(

1,184,979

2016

KD

2016

KD

2015

KD

126