Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2014

Notes to The Consolidated Financial Statement

AL MAZAYA HOLDING COMPANY K.S.C.P. AND ITS SUBSIDIARIES

31 December 2014

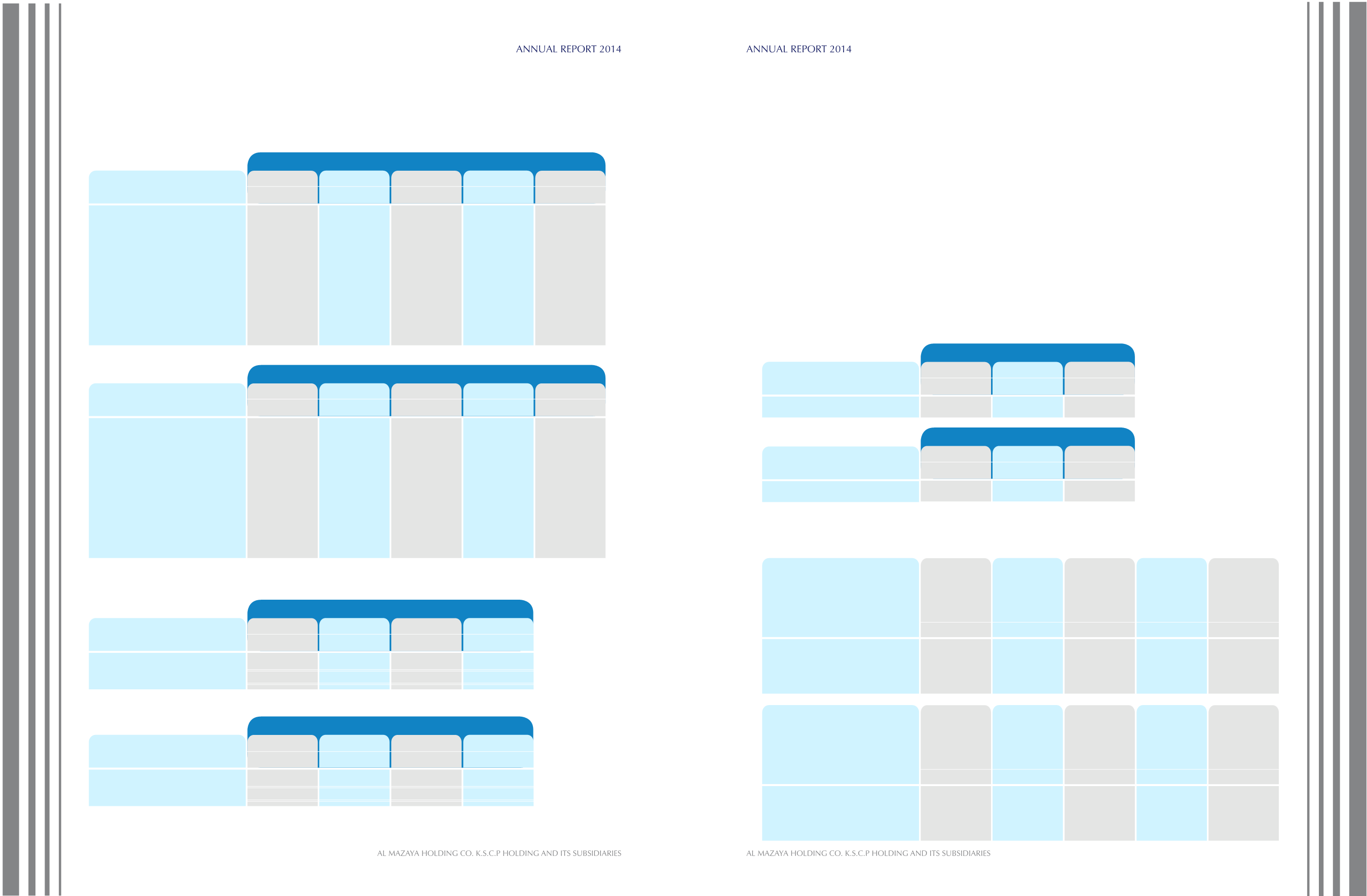

ii) Primary segment information:

iii)

Secondary segment information:

2014

2013

Kuwait

KD

Kuwait

KD

UAE

KD

UAE

KD

KSA

KD

KSA

KD

Others

KD

Others

KD

Total

KD

Total

KD

2013

25,975,940

228,116,141

Residential

KD

Commercial

KD

Total segment revenue

Total segment assets

Other

KD

Total

KD

14,860,760

52,764,086

10,893,939

122,716,722

221,241

52,635,333

2014

16,664,896

261,888,635

Residential

KD

Commercial

KD

Total segment revenue

Total segment assets

Others

KD

Total

KD

8,753,231

74,609,560

7,911,665

133,270,940

-

54,008,135

Other segmental

information:

Change in fair value of

investment properties

Write back of impairment

loss on properties held for trading

Gain (loss) on financial

assets available for sale

Impairment loss on financial assets

available for sale

Other segmental

information:

Change in fair value of

investment properties

Write back of impairment

loss on properties held for trading

Gain (loss) on financial

assets available for sale

Impairment loss on financial assets

available for sale

)807,657(

-

61,129

)61,904(

)558,967(

-

)41,497(

)314,316(

5,154,172

704,717

-

-

221,885

-

-

-

266,058

-

-

-

5,083,148

704,717

)41,497(

)314,316(

)592,294(

2,003,838

-

-

)69,597(

-

-

-

269,599

-

1,614,418

-

)1,199,949(

2,003,838

1,675,547

)61,904(

80

28. CAPITAL COMMITMENTS

The Group has agreed construction contracts with third parties and is consequently committed to future capital expenditure

in respect of properties under construction amounting to KD 17,418,130 (31 December 2013: KD 17,777,462).

The Group has commitments amounting to KD 8,998,633 to purchase land from a third party (Note 24).

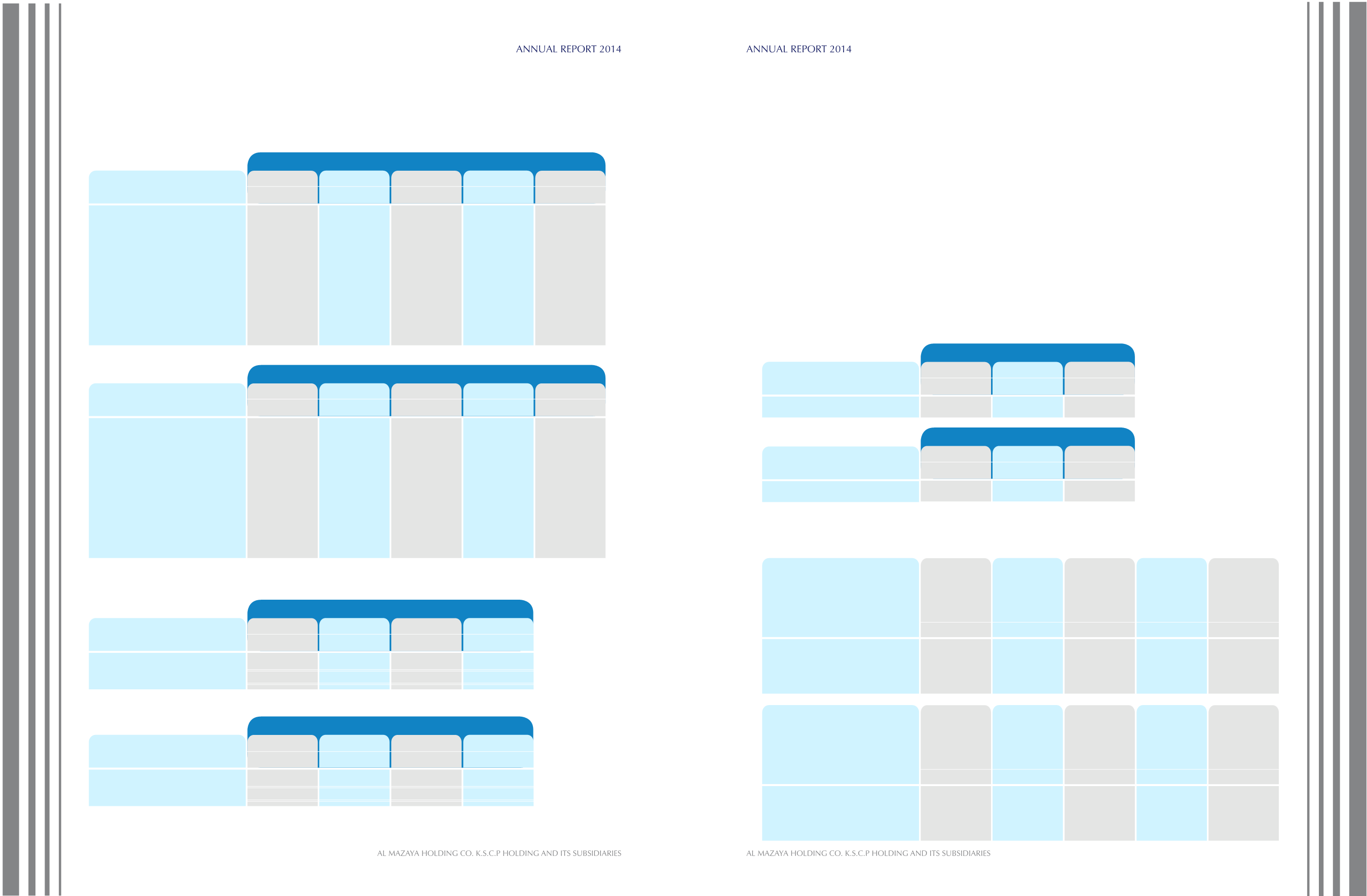

29. FAIR VALUES MEASUREMENT

Financial instruments comprise financial assets and financial liabilities

The fair value of financial assets and financial liabilities that are not carried at fair value is not materially different from

their carrying amounts.

The methodologies and assumptions used to determine fair values of assets is described in fair value section of Note 4:

Significant Accounting Policies.

Financial instruments

The Group held the following financial instruments available for sale fair valued at the reporting date in the consolidated

statement of financial position:

Certain unquoted investments with carrying value of KD 1,931,434 (31 December 2013: KD 2,565,811) are carried at

cost less impairment.

The following table shows a reconciliation of the opening and closing amount of level 3 assets which are recorded at fair

value:

-

At 1 January

2014

KD

Gain

recorded in the

consolidated

statement of

income

KD

Financial assets available for sale:

Funds and managed portfolio

Loss recorded

in other

comprehensive

income

KD

Net

purchases,

sales and

settlements

KD

At

31 December

2014

KD

-

7,478,115

)64,483(

7,413,632

)86,418(

At 1 January

2013

KD

Loss

recorded in the

consolidated

statement of

income

KD

Gain recorded

in other

comprehensive

income

KD

Net

purchases,

sales and

settlements

KD

At

31 December

2013

KD

)125,575(

7,606,660

83,448

7,478,115

2014

2013

10,141,263

10,185,062

Level 1

KD

Level 1

KD

Financial assets available for sale

Financial assets available for sale

Level 3

KD

Level 3

KD

Total

KD

Total

KD

2,727,631

2,706,947

7,413,632

7,478,115

Financial assets available for sale:

Funds and managed portfolio

81